What's my home worth?

Sent

What's my home worth?

Sent

Jessica Averbeck

Find Your Home

What Credit Score Do You Need for a Mortgage?

March 22, 2021

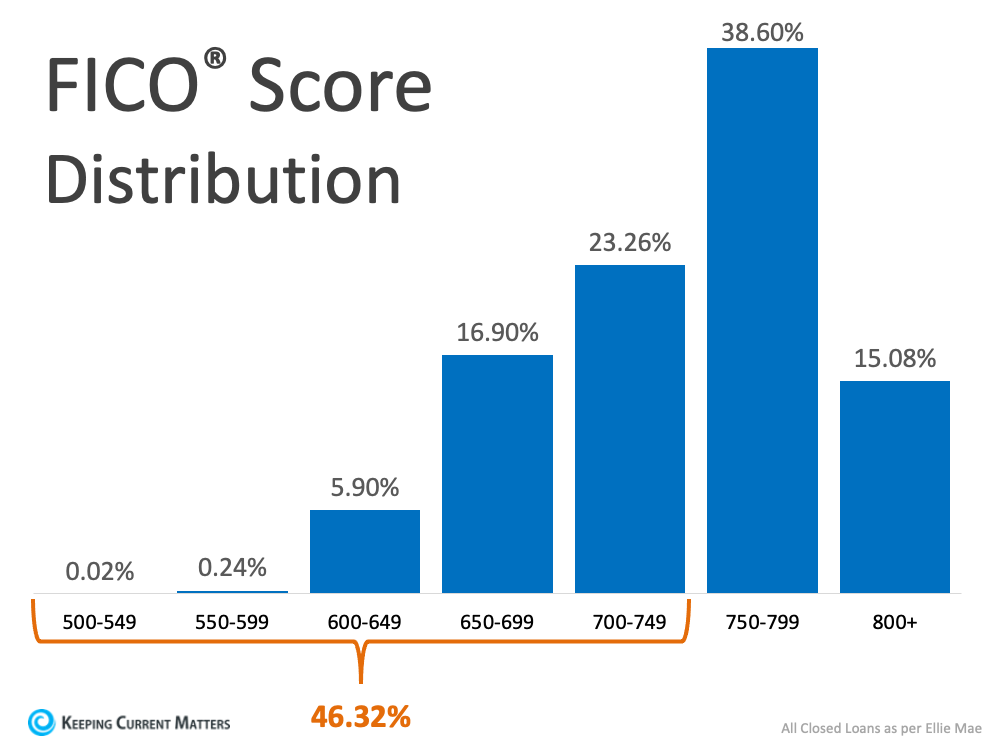

According to data from the most recent Origination Insight Report by Ellie Mae, the average FICO® score on closed loans reached 753 in February. As lending standards have tightened recently, many are concerned over whether or not their credit score is strong enough to qualify for a mortgage. While stricter lending standards could be a challenge for some, many buyers may be surprised by the options that are still available for borrowers with lower credit scores.

The fact that the average American has seen their credit

score go up in recent years is a great sign of financial health. As

someone’s score rises, they’re building toward a stronger financial

future. As more Americans with strong credit enter the housing market,

we see a natural increase in the FICO® score distribution of closed

loans, as shown in the graph below: If

your credit score is below 750, it’s easy to see this data and fear

that you may not be able to qualify for a mortgage. However, that’s not

always the case. While the majority of borrowers right now do have a

score above 750, there’s more to qualifying

for a mortgage than just the credit score, and there are still options

that allow people with lower credit scores to buy their dream home.

Here’s what Experian, a global leader in consumer and business credit reporting, says:

If

your credit score is below 750, it’s easy to see this data and fear

that you may not be able to qualify for a mortgage. However, that’s not

always the case. While the majority of borrowers right now do have a

score above 750, there’s more to qualifying

for a mortgage than just the credit score, and there are still options

that allow people with lower credit scores to buy their dream home.

Here’s what Experian, a global leader in consumer and business credit reporting, says:

- Federal Housing Administration (FHA) loans: “With a 3.5% down payment, homebuyers may be able to get an FHA loan with a 580 credit score or higher. If you can manage a 10% down payment, though, that minimum goes as low as 500.”

- Conventional loans: “The most popular loan type typically comes with a 620 minimum credit score.”

- S. Department of Agriculture (USDA) loans: “In general, lenders require a minimum credit score of 640 for a USDA loan, though some may go as low as 580.”

- S. Department of Veterans Affairs (VA) loans: “VA loans don’t technically have a minimum credit score, but lenders will typically require between 580 and 620.”

There’s no doubt a higher credit score will give you more options and better terms when applying for a mortgage, especially when lending is tight like it is right now. When planning to buy a home, speaking to an expert about steps you can take to improve your credit score is essential so you’re in the best position possible. However, don’t rule yourself out if your score is less than perfect – today’s market is still full of opportunity.

Bottom Line

Don’t let assumptions about whether your credit score is strong enough put a premature end to your homeownership goals. Contact your local real estate professional today to discuss the options that are best for you.

Tags: